IR Information

Print- Trends in business performance

(Consolidated) - Assets Transition

(Consolidated) - Cash Flow Transition

(Consolidated) - Management Index Transition

(Consolidated)

Shareholder's Meeting

NOTICE OF CONVOCATION OF THE 109th ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE OF CONVOCATION OF THE 108th ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE OF CONVOCATION OF THE 107th ANNUAL GENERAL MEETING OF SHAREHOLDERS

Trends in business performance (Consolidated)

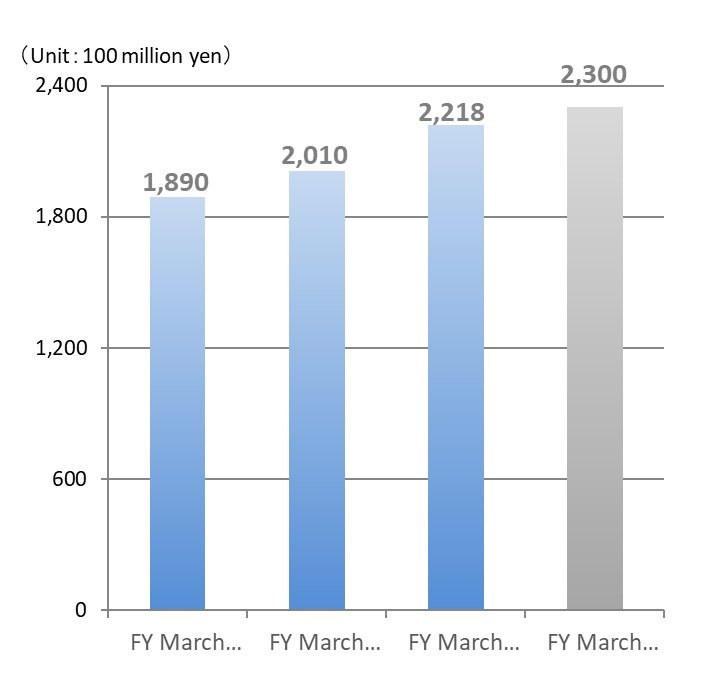

Sales

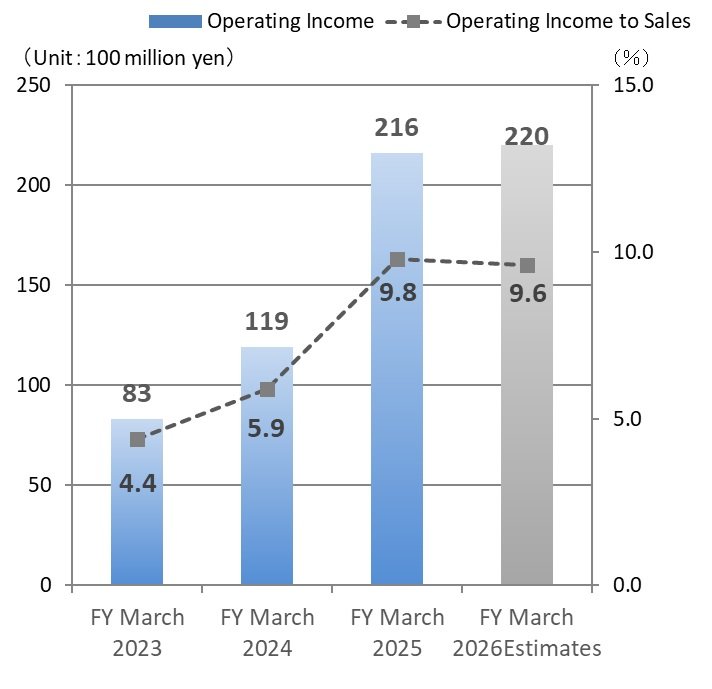

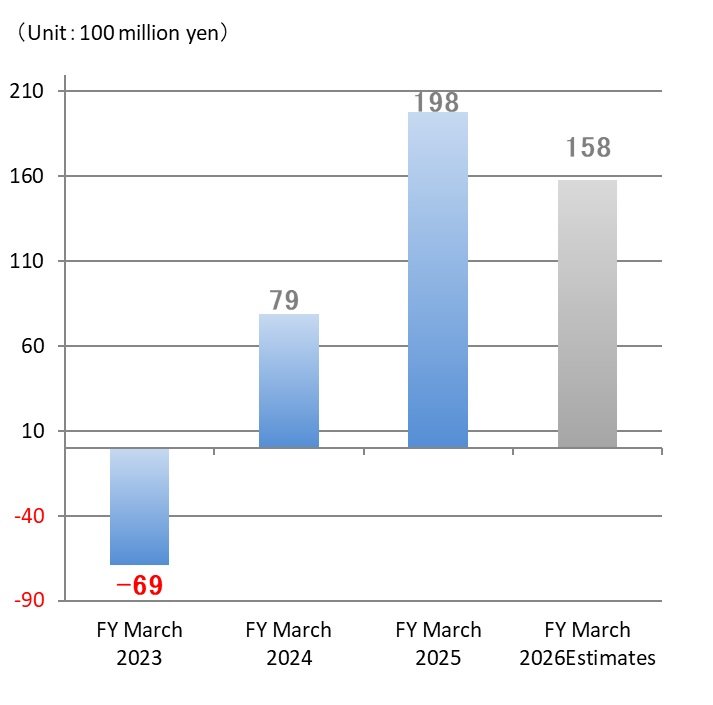

Operating Income/Operating Income to Sales

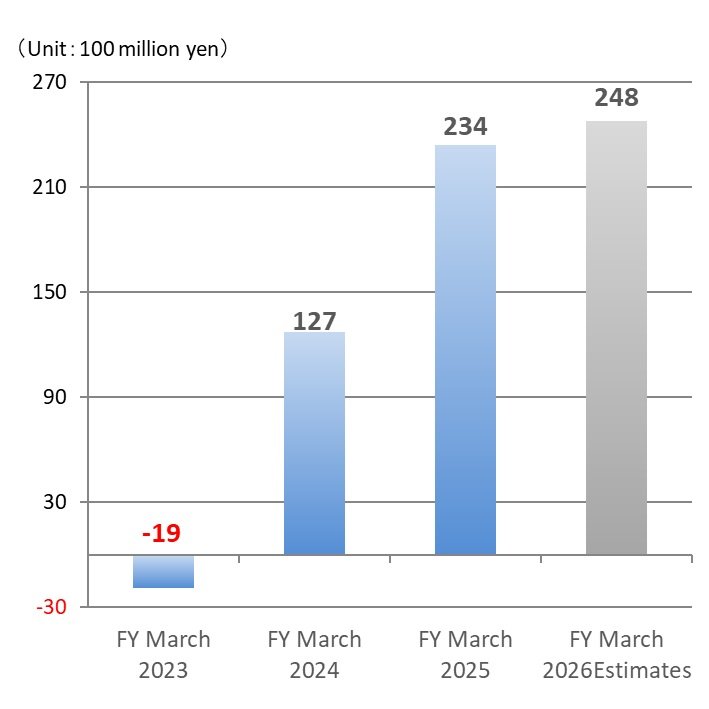

Current Profit

Current Net Earnings

2022年度 FY March 2023 |

2023年度 FY March 2024 |

2024年度 FY March 2025 |

2025年度予想 FY March 2026 Estimates |

|

|---|---|---|---|---|

売上高 Sales |

1,890 | 2,010 | 2,218 | 2,300 |

営業利益 Operating Income |

83 | 119 | 216 | 220 |

営業利益率(%) Operating Income to Sales (%) |

4.4 | 5.9 | 9.8 | 9.6 |

経常利益 Current Profit |

△19 | 127 | 234 | 238 |

親会社株主に帰属する当期純利益 Current Net Earnings |

△69 | 79 | 198 | 158 |

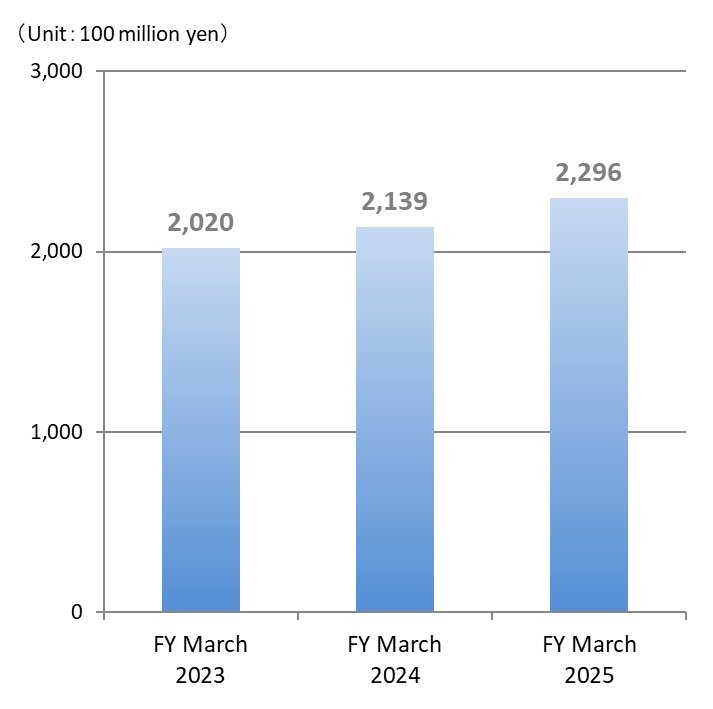

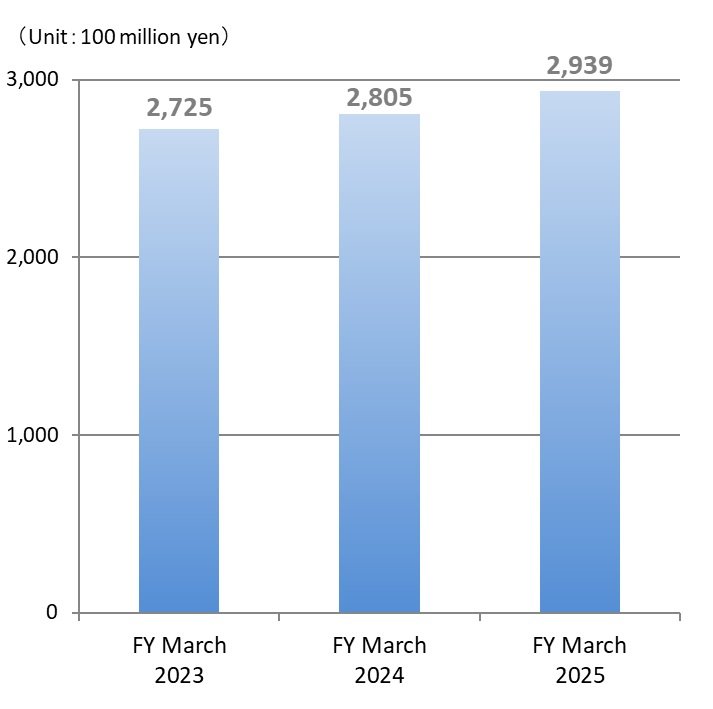

Assets Transition (Consolidated)

Net Assets

Total Assets

2022年度 FY March 2023 |

2023年度 FY March 2024 |

2024年度 FY March 2025 |

|

|---|---|---|---|

純資産 Net Assets |

2,020 | 2,139 | 2,296 |

総資産 Total Assets |

2,725 | 2,805 | 2,939 |

Cash Flow Transition (Consolidated)

2022年度 FY March 2023 |

2023年度 FY March 2024 |

2024年度 FY March 2025 |

|

|---|---|---|---|

営業活動によるキャッシュ・フロー Cash flows from operating activities |

6,181 | 13,721 | 22,754 |

投資活動によるキャッシュ・フロー Cash flows from investing activities |

4,843 | △6,098 | △11,525 |

財務活動によるキャッシュ・フロー Cash flows from financing activities |

△7,512 | △7,316 | △7,643 |

Management Index Transition (Consolidated)

2022年度 FY March 2023 |

2023年度 FY March 2024 |

2024年度 FY March 2025 |

|

|---|---|---|---|

1株当たり当期純利益(EPS)(円) Earnings Per Share (EPS)(Yen) |

△125.62 | 145.37 | 366.88 |

1株当たり純資産額(BPS)(円) Book value per share (BPS)(Yen) |

3,638.70 | 3,893.07 | 4,183.81 |

1株当たり配当金(円) Dividends per share(Yen) |

104 | 104 | 120 |

自己資本比率(%) Capital-to-asset ratio(%) |

73.2 | 75.2 | 77.1 |

自己資本当期純利益率(ROE)(%) Return on equity (ROE)(%) |

△3.4 | 3.9 | 9.1 |

総資産当期純利益率(ROA)(%) Return on asset (ROA)(%) |

△2.5 | 2.9 | 6.9 |

株価収益率(PER)(倍) Price-earnings ratio (PER)(times) |

- | 21.08 | 8.98 |

株価純資産倍率(PBR)(倍) Price-book value ratio (PBR)(times) |

0.59 | 0.79 | 0.79 |